Test Mutiny: Tens of Thousands of New York Parents Revolt Against Standardized Exams

In an act of mass civil disobedience, tens of thousands of parents in New York state had their children boycott the annual English Language Arts exam this week. At some Long Island and upstate school districts, abstention levels reached 80 percent. Protest organizers say at least 155,000 pupils opted out — and that is with only half of school districts tallied so far. The action is seen as a significant challenge to the education agenda of Gov. Andrew Cuomo and to standardized testing nationwide. More than a decade after the passage of No Child Left Behind, educators, parents and students nationwide are protesting the preponderant reliance on high-stakes

Read the rest here

Read the rest here

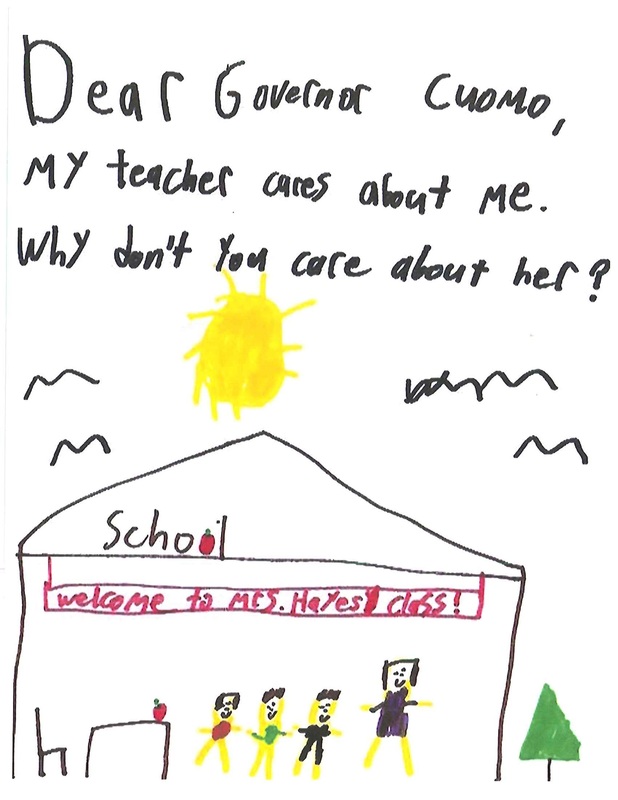

This is a drawing submitted by an elementary student in the GASD.

Please make your voice heard! Speak out against Gov Cuomo's educational reform ideas!

Call your legislators, assemblymen, senators!

Call your legislators, assemblymen, senators!

A nice name for a bad bill

By CECILIA TKACZYK

For The Recorder

Sometimes, legislators will put a nice name on a bad bill to help sell it to the media and the public.

That's the case with the Education Investment Tax Credit Act (EITCA), which sounds like a bill that will provide money for education as well as tax breaks for the residents of New York.

In truth, though, the EITCA would divert hundreds of millions of dollars that should be invested in our public education system to help fund charter, private and other non-public schools. Charter school groups and their supporters have lobbied heavily for it. Last year millions were contributed to political campaigns for the state Legislature and Gov. Andrew Cuomo to push for this measure.

How much? A recent Capitol New York article did the math pointing out that charter schools and their supporters spent $16 million on lobbying and political campaign contributions last year, significantly out-spending unions.

How long has this been going on? A report by HedgeClippers.org tallied political giving by hedge fund executives. Since 2000, 570 hedge fund executives have shelled out nearly $40 million in political contributions to political campaigns for state legislators, PACS, campaign committees, and state-wide elected officials. The single biggest beneficiary is Andrew Cuomo, who received $4.8 million from them since his time in office as attorney general.

The pro-charter advocacy groups and PACs spent heavily during the campaign season in 2014 and now they want results.

The governor and so far the state Senate are not letting them down. The governor included EITCA legislation in his budget proposal. On its very first day of session, the New York State Senate Republican leadership put a version of this legislation on the floor, not bothering to put this controversial legislation through the committee process.

What does this legislation do? The EITCA gives huge tax breaks to corporations and people that donate money to privately operated charter, religious and other private schools and public schools.

When we say huge, we are talking huuuuuuge.

In the governor's version of the EITCA, people and businesses can donate up to $1 million to private schools or charter schools. In exchange they would get a tax credit on their state taxes of 75 percent of the amount they donate.

The state Senate version is even more generous. It allows donors to recapture 90 percent of their contribution. You read that right -- 90 percent of contributions would be returned by reducing the giver's tax liability to the state.

But both versions make clear who will be the true beneficiaries because there is a complicated limited time frame to apply for the tax credit. This process is clearly targeted to well-connected people and corporations who are waiting in the wings to quickly jump on this new tax break.

This tax credit does nothing to address the current opportunity gap that exists between wealthy school districts and poorer districts in upstate New York's rural towns and small cities. In effect, this proposal would transfer the public's tax dollars to sectarian and charter schools, fundamentally altering the policies that regulate and fund New York's public education system.

The measure is opposed by numerous educational organizations and good government groups such as the League of Women Voters, Fiscal Policy Institute, state School Boards Association, Rural Schools Association, among others.

In a joint letter they wrote, "At a time when school leaders are struggling to provide a sound basic education to their students, it is unfair to reward well-resourced educational entrepreneurs who can already take a tax deduction for their contributions with another windfall."

The only thing for sure about this bill -- the rich will get richer. This bad bill with the nice name further distresses our public school system at a time when they can least afford it.

Duanesburg sheep farmer CECILIA TKACZYK

is a former New York state senator.

By CECILIA TKACZYK

For The Recorder

Sometimes, legislators will put a nice name on a bad bill to help sell it to the media and the public.

That's the case with the Education Investment Tax Credit Act (EITCA), which sounds like a bill that will provide money for education as well as tax breaks for the residents of New York.

In truth, though, the EITCA would divert hundreds of millions of dollars that should be invested in our public education system to help fund charter, private and other non-public schools. Charter school groups and their supporters have lobbied heavily for it. Last year millions were contributed to political campaigns for the state Legislature and Gov. Andrew Cuomo to push for this measure.

How much? A recent Capitol New York article did the math pointing out that charter schools and their supporters spent $16 million on lobbying and political campaign contributions last year, significantly out-spending unions.

How long has this been going on? A report by HedgeClippers.org tallied political giving by hedge fund executives. Since 2000, 570 hedge fund executives have shelled out nearly $40 million in political contributions to political campaigns for state legislators, PACS, campaign committees, and state-wide elected officials. The single biggest beneficiary is Andrew Cuomo, who received $4.8 million from them since his time in office as attorney general.

The pro-charter advocacy groups and PACs spent heavily during the campaign season in 2014 and now they want results.

The governor and so far the state Senate are not letting them down. The governor included EITCA legislation in his budget proposal. On its very first day of session, the New York State Senate Republican leadership put a version of this legislation on the floor, not bothering to put this controversial legislation through the committee process.

What does this legislation do? The EITCA gives huge tax breaks to corporations and people that donate money to privately operated charter, religious and other private schools and public schools.

When we say huge, we are talking huuuuuuge.

In the governor's version of the EITCA, people and businesses can donate up to $1 million to private schools or charter schools. In exchange they would get a tax credit on their state taxes of 75 percent of the amount they donate.

The state Senate version is even more generous. It allows donors to recapture 90 percent of their contribution. You read that right -- 90 percent of contributions would be returned by reducing the giver's tax liability to the state.

But both versions make clear who will be the true beneficiaries because there is a complicated limited time frame to apply for the tax credit. This process is clearly targeted to well-connected people and corporations who are waiting in the wings to quickly jump on this new tax break.

This tax credit does nothing to address the current opportunity gap that exists between wealthy school districts and poorer districts in upstate New York's rural towns and small cities. In effect, this proposal would transfer the public's tax dollars to sectarian and charter schools, fundamentally altering the policies that regulate and fund New York's public education system.

The measure is opposed by numerous educational organizations and good government groups such as the League of Women Voters, Fiscal Policy Institute, state School Boards Association, Rural Schools Association, among others.

In a joint letter they wrote, "At a time when school leaders are struggling to provide a sound basic education to their students, it is unfair to reward well-resourced educational entrepreneurs who can already take a tax deduction for their contributions with another windfall."

The only thing for sure about this bill -- the rich will get richer. This bad bill with the nice name further distresses our public school system at a time when they can least afford it.

Duanesburg sheep farmer CECILIA TKACZYK

is a former New York state senator.